when are property taxes due in lake county illinois

Whether you are already a resident or just considering moving to Lake County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. In most counties property taxes are paid in two installments usually June 1 and September 1.

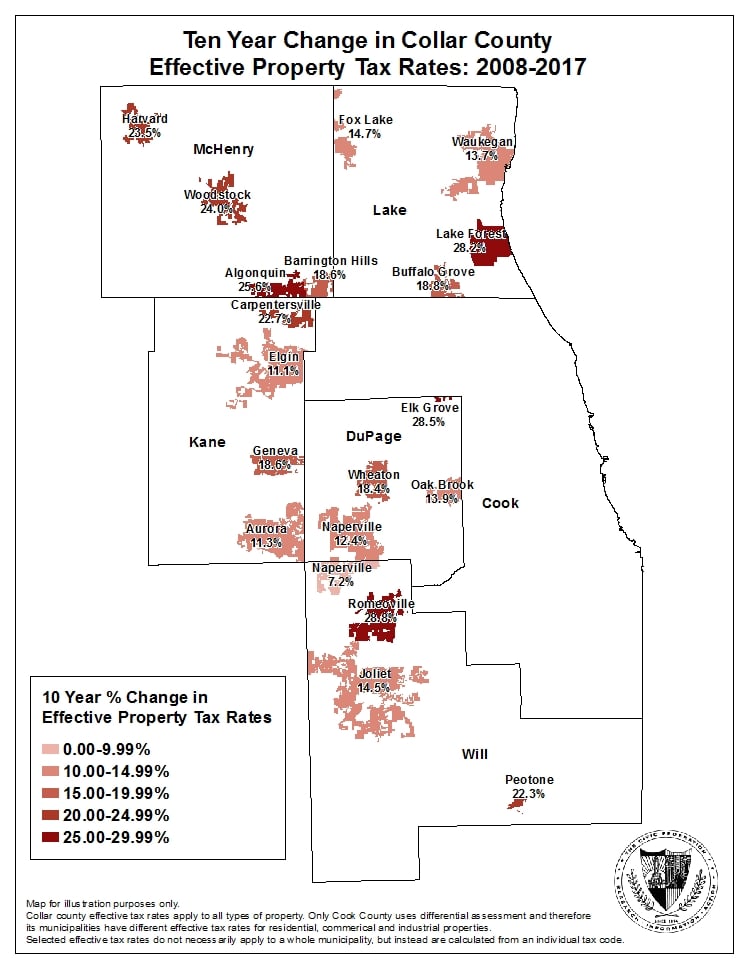

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Lake County 18 N County Street Waukegan IL 60085.

. No warranties expressed or implied are provided for the data herein its use or interpretation. 2 days agoBill Dolan. From the Lake County Treasurers Office.

Select Home Page Menu Image. Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. Lake County Il Property Tax Information.

The Lake County Board passed an ordinance for deferred payment of property taxes without penalties as a result of hardship due to the economic fallout from the COVID-19 pandemic. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Contact Us Monday-Friday 830am-500pm Location Google Map Website.

847-984-5899 Contact Us Parking. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. Lake County 18 N County Street Waukegan IL 60085.

Township Assessors Get 3 000 Bonus For Doing Job Right Township Property Tax Job 2017 Effective Property Tax Rates In The Collar Counties The Civic Federation. FAQs What happens if i dont pay my property taxes in time. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021.

Not receiving a tax bill medical emergencies travel or payment history do not qualify for exemption. The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible. When are property taxes due in lake county illinois Saturday March 12 2022 Edit.

LINCOLNSHIRE-PRAIRIE VIEW SCH DIST 103. We perform a vital service for Lake Countys government and residents and Im honored to serve as your Treasurer. Under Illinois law areas under a disaster declaration can waive fees and change due dates on property taxes.

Tax Lien on Property. 847-377-2000 Contact Us Parking and Directions. For this year due dates are June 6th and September 6th therefore the penalty is calculated on the 7th of each month and is not prorated by state law.

A Right to Challenge and Appeal Your Assessment. On may 12 2020 the lake county board passed a one time ordinance giving property owners more time to pay each installment of their property taxes due to impacts of covid 19. How much are property taxes in Lake County IL.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. Lake County property owners will receive this notification in approximately two weeks. Property tax bills for 2021 payable in 2022 are now in the mail and available online and we are accepting payments.

STEVENSON HIGH SCHOOL DISTRICT 125. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Tax amount varies by county. County Median Home Value Average Effective Property Tax Rate. Illinois Property Tax Rates.

Your property tax dollars help make Lake County a great place to live work and visit. Forgiveness of the penalty must be due to a Lake County error and must be documented. Lake County collects on average 219 of a propertys assessed fair market value as property tax.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Contact your county treasurer for payment due dates. Payments that are mailed must have a postmark.

The Lake County Treasurers Office will be sending notice of the deferred payment plan to Lake County property owners through the mail. Lake County IL 18 N County Street Waukegan IL 60085 Phone. May 12 2020.

Skip to Main Content. Additional 1 5 interest on past due balance per state statute. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax.

Lake County has one of the highest median property taxes in the United States and is ranked 15th of the 3143 counties in order of median property taxes. All 102 counties in Illinois are considered disaster areas by both the state and federal governments because of COVID-19. Lake County property taxpayers receive their tax bill from the Lake County Treasurer in May with due dates in June and September.

50 of the second installment payment is due by Nov. Learn all about Lake County real estate tax. Site Appearance Format Images.

173 of home value. VIL OF BUFFALO GROVE. Unit K-12 School District.

Can you sell a house immediately after buying it. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. COLLEGE OF LAKE COUNTY 532.

The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. Illinois homeowners again paid the nations second-highest property taxes behind New Jersey in the annual survey by WalletHub. 18 N County Street Room 102 Waukegan IL 60085 Phone.

847-377-2000 Contact Us Parking and Directions. Lake County 18 N. Current Real Estate Tax.

Under the ordinance Lake County property owners must still pay the full amount of property taxes due. Access important payment information regarding payment options and payment due dates for property taxes. The Lake Porter and LaPorte county treasurers remind Northwest Indiana residents they have until Tuesday to pay the first installment.

Lake County Il Property Tax Information

Lake County Il Property Tax Information

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Lake County Il Property Tax Information

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Lake

The Cook County Property Tax System Cook County Assessor S Office Property Tax County New Trier

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Homes For Rent In Kane And Mchenry County In 2022 Renting A House Real Estate News Algonquin

Lake County Real Estate Tax Appeal Estate Tax Lake County Illinois

Lake County Property Tax Getjerry Com

Pin By Amc Abodes Agentannecook Com On Lake County Illinois Agentannecook Com Lake County Ingleside Open House

Kentucky Property Taxes The Homestead Exemption For Owensboro Ky Property Owners Tony Clark Real Estate Owensboro Kentuc Kentucky Owensboro Property Tax

Lake County Il Google Search Evanston Chicago Evanston Illinois

Property Tax City Of Decatur Il

Lake County Il Property Tax Information

Township Assessors Get 3 000 Bonus For Doing Job Right Township Job Property Tax